Simfund is the premier business intelligence platform for the asset management industry with comprehensive coverage of over 140,000 funds, ETFs, and financial products representing over $127T USD assets under management across 40 markets. This highly configurable platform provides best-in-class asset management datasets within a flexible analytical tool, enabling benchmarking, asset flow, and trend analysis across a comprehensive set of managers, asset classes, retail/institutional vehicles, and regions.

Simfund’s actionable insights support a broad range of use cases

PRODUCT STRATEGY AND DEVELOPMENT

Assess which products to develop and which markets to enter; monitor characteristics of top-selling funds and which new funds are launching; understand how products compare on ESG data points.

STRATEGY AND

FINANCE

Quantify the market size and relative market share; analyze peer fees and expenses including benchmarking outsourced providers; stay ahead of industry trends and identify acquisition candidates.

COMPETITIVE INTELLIGENCE/

BENCHMARKING

Identity which competitor funds are outperforming in their respective sectors; understand who is winning/losing fund flows; learn how fees differ at share class levels.

MARKETING AND DISTRIBUTION

Evaluate fund flows across multiple dimensions and regions; identify areas of opportunity and risk to focus marketing and sales efforts.

Why Simfund?

- Full transparency of assets, flows, performance, risk, responsible investing, and other fund characteristics at the share class level on one platform.

- Extensive peer group and benchmarking capabilities.

- Enables speed to market through identification of market opportunities and robust competitive intelligence.

- Flexible and modular data sets with a breadth of data attributes and flags.

- Customizable and configurable analytics, tools, dashboards, and workbooks.

- Retail and institutional vehicle coverage on one integrated platform.

- Actionable and unbiased research and insights powered by Simfund data.

Integrated Platform with

Enhanced Analytics

Comprehensive

Global Data Coverage

Data attributes captured across managers, regions, asset classes, and vehicles include:

- AUM Net Flows

- Net asset and cross-border flows

- Fees and expenses

- Performance and risk factors

- Responsible Investing

- Subadvised funds

- Fund of funds

- Variable annuities

Core Platform With Modular Datasets

U.S. Data Sets

A platform enabling comprehensive competitive analysis of U.S.-based mutual funds and ETFs with thousands of data points across multiple data sources.

Additional Offerings Available:

Subadvisory

Comprehensive tracking of mandates across open-end, closed-end, and variable funds with detailed performance and fee analytics to make targeting opportunities easy.

FundFiling

Complete database of new fund registrations and fund changes updated daily, including fund to ETF conversions and 50+ other activities, direct access to Fund Profiles and SEC filings.

Total Market

Consolidated view of retail and institutional data on an integrated platform; including SMAs, CITs, private market funds/alternatives, and other hard-to-access institutional data.

Variable Annuities

Benchmark the variable annuity marketplace and monitor industry trends by insurance companies, investment managers, products, funds, and sub-accounts across multiple data attributes, including net flows, assets, performance, risk, fees, expenses, and more.

Annuity Insight

Daily competitive intelligence and commentary on the latest trends in variable annuity (VA) and registered index-linked contracts (RILA), as well as underlying funds. Powerful email alerts, search engines and industry insights supported by unparalleled client service.

Global Data Sets and Cross-border Flows

The premier global data platform integrating the industry’s best-in-class proprietary and third-party datasets for advanced business intelligence across every major fund market. Learn more about Simfund Global.

Additional Offerings Available:

Fund of Funds

Enabling users to identify opportunities and examine relationships between fund of funds and their fund holdings globally.

Fees and expenses

(UK and Irish-domiciled funds)

Comprehensive coverage for U.K. and Irish-domiciled funds to support Assessment of Value reporting and customized peer benchmarking analytics.

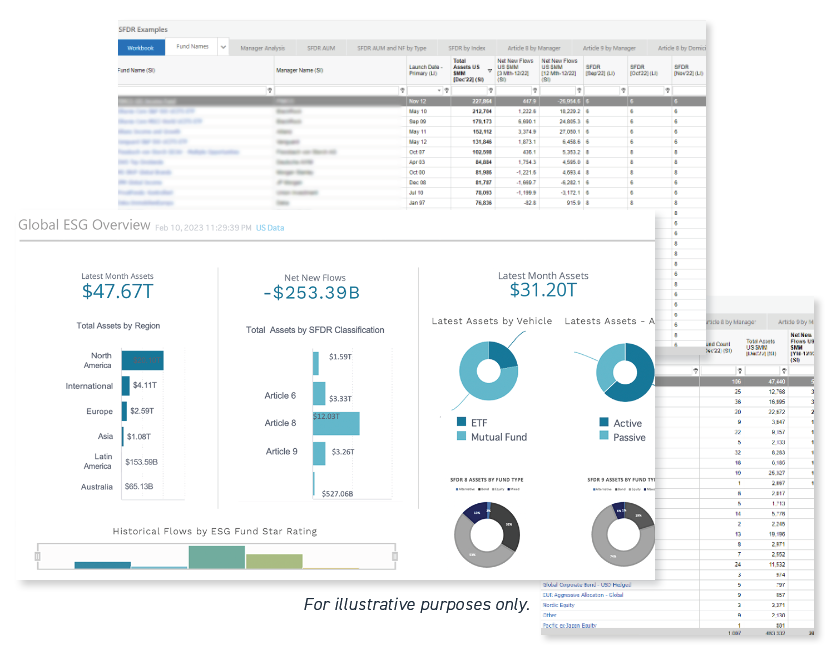

Responsible investing data (ESG, SFDR)

Expanded ESG data set including SFDR classifications (Articles 6, 8,9) inclusive of historical data, breadth of ESG data attributes, and ISS ESG fund rating data

Global Consortium

Consortium members can size markets identify cross-border and local fund opportunities with gross and net flows, and analyze their market share and ranking across multiple dimensions within each country.

Learn More

Canada Data Sets

The Trusted Business Intelligence Tool for Strategic and Product Decisions in the Canadian Fund Market empowering users to quickly construct fund industry analyses and pinpoint emerging trends in the Canadian funds industry.

Learn More

Australia Data Sets

Supporting the financial industry in its product, marketing, distribution, benchmarking, and research efforts covering Australian superannuation and managed funds investment markets.

Learn More